Company Background

Arabian American Development Company (originally Arabian Shield Development Company) has been engaged in developing a base metal mining property in Najran Province - in southwest Saudi Arabia - since the late 1970s.

During 2008 Arabian American Development Company (ARSD) and seven Saudi investors formed a joint stock company under the name of Al Masane Al Kobra Mining Company (AMAK) for the purpose of developing the Al Masane Project which is in the southwest quadrant of the Kingdom. AMAK received the commercial license from the Ministry of Commerce in Saudi Arabia in January 2008. The Saudi investors contributed US$60 million in cash.

In December 2008, ARSD transferred the Al Masane mining leases and certain other assets and liabilities to AMAK. In consideration for this transfer to AMAK, Arabian American Development Company holds 41% of the issued and outstanding shares of AMAK. AMAK has secured, with the contributed equity and through loans from the Saudi Industrial Development Fund, the necessary funds to complete the Al Masane Project, The head office of AMAK is located in Jeddah, Saudi Arabia.

AMAK Board of Directors consists of Dr. Talal Al Shair, Chairman, and Mohamed Aballala, Ibrahim Al Mussallum, Ayman Al Shibl,

Charles Goehringer, Jr, Allen McKee, Ghazi Sultan and Nick Carter. The

Management team consists of Mohamed Aballala, Managing Director, Ed Mueller,

Executive Project Manager, and Zeyad Tawil, Manager.

Project Location and Investment Climate

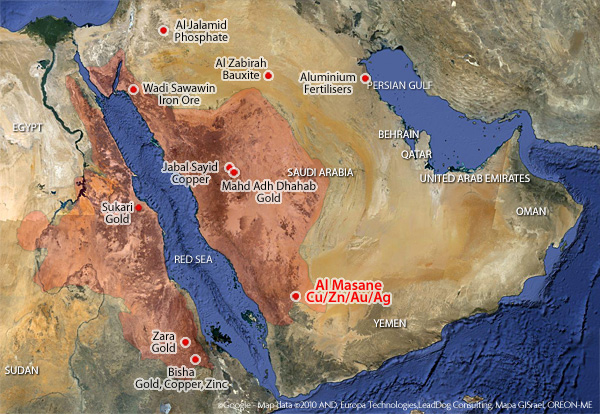

The Arabian Shield has been vastly under-explored. In the late 70's and early 80's, BRGM (Bureau de Recherches Géologiques et Minières) identified over 6,000 defined prospects and occurrences, many of which have not been progressed beyond rudimentary first pass exploration.

The new Mining Code adopted by the Saudi government in 2005 is the basic framework for controlling exploration and mining activities in the Kingdom.

- Exploration and mining projects are encouraged

- Investments governed by new mining legislation in 2005

- Tenure of mining license secure

- Highly competitive mining costs

- Debt financing available from local banks/government institutions

- Developed infrastructure, roads, ports, etc.

- Attractive tax regime

Al Masane Project Information

JORC Compliant Ore Reserve Study Project Overview

Completed Sept. 2009 by Watts, Griffis and McQuat

Introduction

Al Masane Al Kobra Mining Company is a precious metals and base metals developer focused on the completion and production of the 700,000 tpa copper, zinc and precious metals Al Masane Mine in Saudi Arabia. The Al Masane Project is fully funded and permitted. As of mid 2010, the surface facilities were completed and waiting for testing prior to delivery of ore. The contract to continue mine development has been awarded and pre-production development has commenced.

Production of copper concentrate, zinc concentrate, gold and silver bullion is scheduled for the 3rd quarter 2011.

The project is located in southwestern Saudi Arabia, approximately 640 km south east of Jeddah. It lies some 414 km by a newly paved road from the port of Gizan on the Red Sea. The mines copper and zinc concentrates will be trucked to the port of Gizan and shipped to smelters in Europe or the far east.

In addition to the known ore reserves that are being developed, exploration of gossans and geochemical anomalies in the greater Al Masane area has indicated that there is a high probability of discovering additional minable resources which will increase the life of mine.

Geology

The Arabian-Nubian Shield is the exposed region of the Precambrian Arabian plate and crops out over 777,000 km2 in the western part of the Kingdom (Fig 3-1). It is comprised of metamorphosed sedimentary and volcanic rocks intruded by younger granite and gneisses.

The Arabian-Nubian Shield is the northern half of a great collision zone called the East African Orogen. This collision zone formed near the end of Neoproterozoic time when Eastern and West Gondwana collided at the northern end of the East African Orogen.

Mineral Resource and Ore Reserves

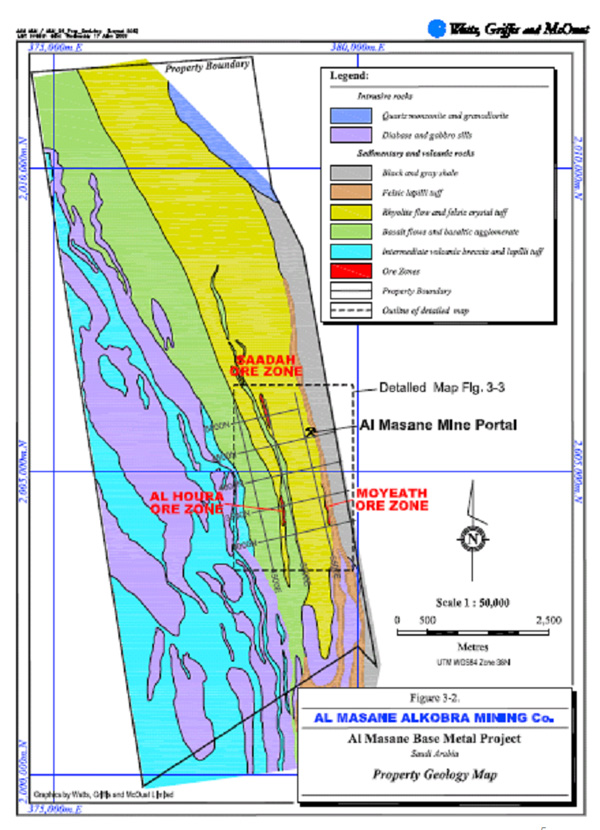

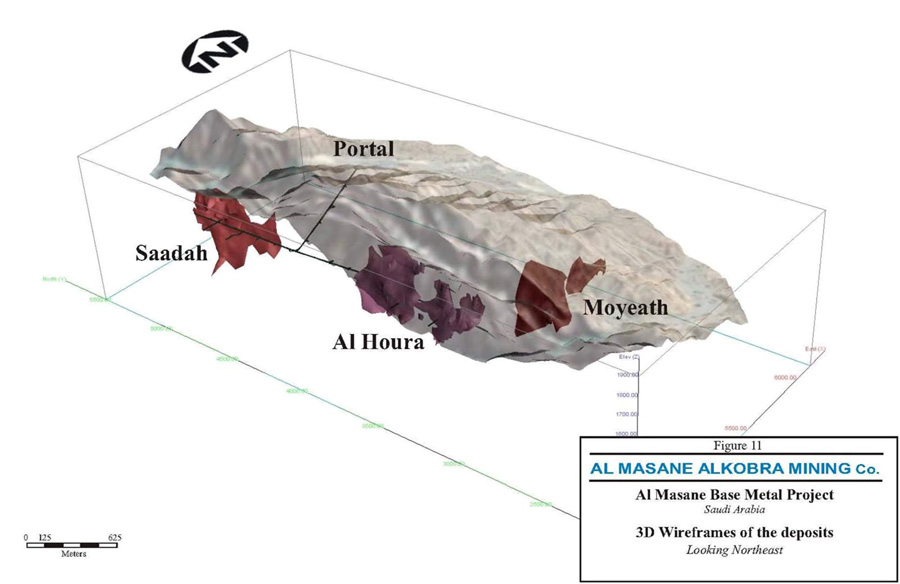

Three mineralized zones, the Saadah, Al Houra and Moyeath, have been outlined by diamond drilling. The Saadah and Al Houra zones occur in a volcanic sequence that consists of two mafic-felsic sequences with interbedded exhalative cherts and metasedimentary rocks. The Moyeath zone was discovered after the completion of underground development in 1980. It is located along an angular unconformity with underlying felsic volcanics and shales. The principal sulphide minerals in all of the zones are pyrite, sphalerlte, and chalcopyrite. The precious metals occur chiefly in tetrahedrite and as tellurides and electrum.

| AL MASANE RESOURCE AT 5.0% ZN EQUIVALENT CUTOFF ( as of March 31st 2009 ) | ||||||||||

Tonnage (t x 1000) |

Zn (%) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Zneq Grade |

Zn mil lb |

Cu mil lb |

Au Oz (000's) |

Ag Oz (000's) |

|

|---|---|---|---|---|---|---|---|---|---|---|

Measured |

||||||||||

Al Houra |

75 | 4.10 | 0.70 | 0.65 | 19.1 | 7.44 | 6.8 | 1.2 | 1.6 | 46.1 |

Saadah |

610 |

3.73 |

1.43 | 0.81 | 21.6 | 9.47 | 50.1 | 19.2 | 15.9 | 423.5 |

Moyeath |

0 | 0.00 | 0.00 | 0.00 | 0.0 | 0.00 | 0.0 | 0.0 | 0.0 | 0.0 |

Indicated |

||||||||||

Al Houra |

2,537 | 4.07 | 0.98 | 1.19 | 38.1 | 9.37 | 227.8 | 54.8 | 97.1 | 3,107.3 |

Saadah |

5,445 |

3.84 |

1.35 | 0.85 | 24.8 | 9.49 | 461.4 | 161.9 | 148.5 | 4,347.6 |

Moyeath |

766 | 7.95 | 0.89 | 1.28 | 63.0 | 13.61 | 134.2 | 15.0 | 31.6 | 1,550.0 |

Measured + Indicated |

||||||||||

Al Houra |

2,612 | 4.07 | 0.97 | 1.17 | 37.5 | 9.32 | 234.6 | 56.0 | 98.6 | 3,153.5 |

Saadah |

6,055 |

3.83 |

1.36 | 0.84 | 24.5 | 9.49 | 511.5 | 181.1 | 164.4 | 4,771.2 |

Moyeath |

766 | 7.95 | 0.89 | 1.28 | 63.0 | 13.61 | 134.2 | 15.0 | 31.6 | 1,550.0 |

Total Measured + Indicated |

9,433 | 4.23 | 1.21 | 0.97 | 31.24 | 9.77 | 880.3 | 252.0 | 294.7 | 9,474.7 |

Inferred |

||||||||||

Al Houra |

42 | 3.88 | 1.04 | 0.98 | 32.4 | 8.93 | 3.6 | 1.0 | 1.3 | 43.8 |

Saadah |

43 |

4.25 |

1.29 | 1.23 | 31.4 | 10.37 | 4.0 | 1.2 | 1.7 | 42.9 |

Moyeath |

518 | 7.97 | 0.97 | 1.19 | 60.2 | 13.70 | 91.0 | 11.1 | 19.8 | 1,003.3 |

Total Inferred |

603 | 7.42 | 1.00 | 1.18 | 56.2 | 13.13 | 98.6 | 13.3 | 22.8 | 1,090.0 |

|

||||||||||

Statement of ore reserves

The Ore Reserves as estimated by WGM in this study are shown below. WGM considers that the Ore Reserve estimate meets the technical and economic requirements of the JORC Code (2004) for Ore Reserve estimation. WGM has used the economic model to confirm that all three mining zones make a positive contribution to project value.

| AL MASANE ORE RESERVES EFFECTIVE DATE 1 JULY 2009 | |||||||||

Contained Metal -------------------------------------------------------- |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

Tonnes (000's) |

Zn (%) |

Cu (%) |

Au (g/t) |

Zn t(000's) |

Cu t(000's) |

Au kg (000's) |

Ag kg (000's) |

Au Oz (000's) |

|

Proven Ore Reserves |

|||||||||

Saadah |

448 | 3.7 | 1.5 | 0.8 | 21 | 16,485 | 6,511 | 356 | 9,622 |

Al Houra |

29 |

3.8 |

0.8 | 0.7 | 21 | 1,100 | 221 | 21 | 620 |

Moyeath |

- | - | - | - | - | - | - | - | - |

Total Proven Ore Reserves |

477 | 3.7 | 1.4 | 0.8 | 21 | 17,584 | 6,731 | 377 | 10,243 |

Probable Ore Reserves |

|||||||||

Saadah |

5,193 | 3.4 | 1.2 | 0.8 | 23 | 179,103 | 63,486 | 3,947 | 116,991 |

Al Houra |

1,894 |

3.8 |

0.9 | 1.2 | 39 | 71,448 | 17,478 | 2,330 | 72,955 |

Moyeath |

702 | 7.2 | 0.8 | 1.0 | 55 | 50,322 | 5,770 | 726 | 38,683 |

Total Probable Ore Reserves |

7,789 | 3.9 | 1.1 | 0.9 | 29 | 300,874 | 86,734 | 7,003 | 228,629 |

Total Ore Reserves |

|||||||||

Saadah |

5,641 | 3.5 | 1.2 | 0.8 | 22.4 | 195,588 | 69,996 | 4,303 | 126,614 |

Al Houra |

1,923 |

3.8 |

0.9 | 1.2 | 38.3 | 72,548 | 17,699 | 2,351 | 73,575 |

Moyeath |

702 | 7.2 | 0.8 | 1.0 | 55.1 | 50,322 | 5,770 | 726 | 38,683 |

Total Ore Reserves |

8,266 | 3.9 | 1.1 | 0.9 | 28.9 | 318,458 | 93,465 | 7,381 | 238,872 |

1) Ore Reserves are estimated using metal prices of US$0.85/lb Zn, US$2.50/lb Cu, US$800/oz Au and US$12.0/oz Ag. transportation costs and taxation. |

|||||||||

Mining

Mine Description

The Al Masane mine is an underground mine with a surface milling facility. The underground area of the mine is accessed by a ramp from surface down to the lower workings.

The ore will be mined from three mineralized zones, the Saadah, Al Houra and Moyeth. The feasibility study recommended an underground mining method to be a form of bench and fill, which combines reasonable productivity, medium cost with the added security of ground control by filling of stopes with uncemented rockfill as mining advances.

All ore and waste will be moved within the mine by scoop trams and trucks. Two size scoop trams will be used for narrow veins and for larger stopes.

Diesel trucks will be used to haul the ore, waste and rock fill. Ore will be delivered to the run of mine ore pad or directly tipped to the adjacent crusher 250 m from the portal on surface.

Mine Development

Ramps and development where truck access is required will be mined 4.5 mW x 5 m. Dimensions of access development for entry of 4.8 m3 scoops only will be reduced to 4 mW x 4 mH. In narrow vein development 1.9 m3 scoops will be used and dimensions reduced to 3 mW x 3 mH. Ramps will be mined at 15% gradient.

Raises will be mined with hand-held drills using and alimak raise climber or, where possible with shorter raises between sub-levels, by drop raising using a longhole drill. The main return air raises from each mining zone will be equipped with a ladder for emergency egress. Due to the remote surface location of the Al Houra ventilation raise WGM has assumed that power for the main fan will be carried through the mine rather than over the surface.

Mine Design Modeling

Mine design modelling was completed using Gemcom's Surpac V6.1.0. The design was based on previous "as built" data as supplied by AMAK. This design consists of a portal, a crosscut ramp and a trackless exploration drift straddling the hangingwall and footwall of the mineralized area. This development was utilized significantly in the updated design.

Access to Sadaah was designed immediately off the crosscut ramp with immediate, permanent access to the ore area. The exploration drift in this area was not used. Haulage distances, and ore access were limitations in utilizing the existing 1515 level.

A new footwall development was selected as the optimal approach allowing the existing drift to remain intact for future exploration and development potential. The primary development design is based on 25 m level spacing with a central 25 m radius spiral ramp [4.5 mH x 5 mW]. Sills are modelled at various widths as per ore width (generally 3 mH x 3 mW or 4.5 mHx4 mW). For widths in excess of 13 m, 2 sills were used. Supporting infrastructure are orepasses and ventilation raises. All design components are centrelined with applicable cross section profiles used for solid modelling (Figure 5-5).

The mine design for Al Houra uses the existing 1515 (1510) level for access and mining. A vent raise is the first development to be completed and allows initial development and mining to start. The mine design model has a 2 spiral ramp arrangement with 25 m level spacing.

Moyeath has been approached as an independent mine target. The mine has no connection to the existing mine. A new portal is modelled as well as the infrastructure using a 4 spiral ramp arrangement (3 primary spirals and 1 tail off spiral at the bottom) with 25 m level spacing.

A standardized mine design and modelling approach has been adopted in all areas.

Processing Plant and Surface Facilities

The surface facilities consist of a concentrator with a precious metals plant with a designed capacity of 2,000 tonnes per day. In addition, the facilities include a power plant, service shops, laboratory, tailings impoundment, living quarters for staff and labour and service buildings.

The concentrating plant will consist of the following main areas:

- Single stage crushing of ROM ore

- Closed circuit SAG mill

- Closed circuit ball mill

- Sequential talc, copper, zinc flotation

- Cyanidation of zinc concentrate and tailings

- Precious metals recovery by Merril Crow.

Process Flow Sheet

Concentrator

The mineral processing area includes a 2,000tpd process plant (concentrator) and directly associated infrastructure. Power is supplied to all units from the power generation plant, transformers and motor control centre.

Run of mine ore is crushed with a 900 X 1,200 mm primary jaw crusher. The crushed ore is conveyed to a stockpile and fed to the grinding circuit.

Primary grinding is carried out by a semi-autogenous SAG mill 5.5 m by 2.4 m long. The mill undersize discharge is directed to a cyclone feed pump box. The oversize material is directed to a cone crusher and the crushed product is fed back to the SAG mill feed chute.

Talc conditioning and flotation consists of two 3.5 m dia.X 3.5 m tall conditioning tanks and rougher and cleaner flotation and two filter presses.

Talc tailings are pumped to the copper conditioning tanks and further to copper flotation. The copper concentrate is thickened and filtered by filter presses.

Tailings from the copper circuit are fed to zinc agitation tanks and then to zinc flotation. Final tails are pumped to a tailings thickener, where the underflow feeds the tailings cyanidation circuit.

The zinc concentrate is thickened and fed to the cyanidation circuit for precious metals recovery.

Precious metals metals recovery from the zinc concentrates and zinc tailings is via leach circuits and Merill-Crowe precipitation.

Tailings will be transported from the plant to the tailings dam using a small fleet of trucks. The tailings facilities will be a zero discharge design and will conform to Saudi Arabian national environmental legislative requirements.

| Metallurgical Projection from the BGRIMM Testwork | |||||||||

Product |

Weight |

Grade |

% Distribution |

||||||

|---|---|---|---|---|---|---|---|---|---|

(%) |

Cu (%) |

Zn (%) |

Au (%) |

Ag (%) |

Cu |

Zn |

Au |

Ag |

|

Talc C1 Conc |

13.7 | 0.14 | 0.82 | 0.38 | 14.0 | 1.60 | 2.43 | 6.06 | 6.39 |

Cu C1 Conc |

4.77 | 22.4 | 4.78 | 5.17 | 239 | 89.1 | 4.92 | 28.6 | 37.9 |

Zn C1 Conc (leached) |

7.29 |

0.52 |

54.7 | 0.63 | 48.0 | 3.16 | 85.9 | 5.07 | 11.6 |

Bullion |

- | - | - | - | - | - | - | 40.4 | 31.2 |

Au Ro Tail (leached) |

74.2 | 0.10 | 0.42 | 0.24 | 5.21 | 6.18 | 6.72 | 19.8 | 12.8 |

Calculated Head |

100.0 | 1.20 | 4.47 | 0.90 | 30.1 | 100.0 | 100.0 | 100.0 | 100.0 |

Infrastructure

Explosive Magazine

The explosives magazine is is located in a remote site north of the tailings area. The area is secured with fencing and a gatehouse. An explosives storage room is provided within the magazine.

Process Plant Effluent Treatment Plant

Wastewater from the process plant area is processed in a steel framed building. The plant receives contaminated from the flotation and leach process.

Air Compressor Room

An air compressor room is provided within the dewatering building

Power Plant

The power plant for the processing plant is housed in a single building. The building houses 8 by 900kW, 10kV diesel generators, switch room, transformer room, power distribution room and central control room.

Auxiliary Surface Infrastructure

The auxiliary surface infrastructure will provide central services and administration facilities.

Central Warehouse

Central Workshops

Assay Labs

Administration Offices

Camp Areas

Water Supply Area

Dining Facilities

Senior Management Facilities

Laundry

Mosque

Port Facilities

The port facility will include truck off loading, a 10,000 sqm storage area, and ship loading facilities for two discrete concentrates, each delivered in bulk form (~30t trucks).Production

The Al Masane mine feasibility study production results are summarized as follows:

| Production Summary | Run of Mine Ore to Mill |

8,267,000 tonnes at: Zinc = 3.85% Copper = 1.13% Gold = 0.89 g/t Silver = 28.90 g/t |

|---|---|

Annual Run of Mine Ore to Mill |

720,000 Tonnes per annun |

Recovery |

Zinc = 85.7% Copper = 89.1% Gold = 28.6% to Conc 40.4% to bullion Silver = 37.9 % to Conc 31.2% to bullion |

Grade |

Copper =- 22.4% |

Average Production |

Copper Concentrate =35,000 dry t/a Zinc Concentrate = 45,000 dry t/a |

Mine Life (production) |

11.5 years |

Environmental and Permitting

The methodology of this study is based on information and data collection that is available at AMAK. In addition, data was collected by the team of ESCO specialists during their site visits to assess the project site and evaluate the current environmental situation. Furthermore the ESCO specialists studied the stages of construction and operation and identified the various steps of operation, equipment and machinery used in mining and transport.

The components of the surrounding environment that could be affected by the establishment and operation of the mine have been identified; the collected information and data are being utilized 1.) to assess the expected environmental impacts and potential sources of environmental pollution, 2.) to assess the extent of their impact on the area around and its compliance with the environmental standards and guidelines issued by the Presidency of Meteorology and Environment Protection ("PMfE"), then 3.) to propose appropriate environmental management plans.

Summary

Based on the results of this environmental impact assessment for the establishment and operation of a factory at the Al Masane location for AMAK for mining at Wadi Sada and Wadi Hammer, the study concludes that there is no significant negative environmental impact that may occur on the establishment of this project; compared to the size of the damage and the environmental benefit.

Project Capital and Operating Cost

| Pre-Production Capital Cost | |

Mine |

$50 million |

|---|---|

• Mobile equipment • Mine development • Mine infrastructure |

|

Process & Surface Infrastructure |

$114 million |

• Concentrator • Power Plant • Auxiliary surface infrastructure • Camp • Tailings Dam Port Facilities • Spare Parts |

|

Owners Cost |

$6 million |

Total Pre-production Capital |

$170 million |

| Operating Costs | ||

Mining |

($/t mined) | $26.85 |

|---|---|---|

Concentrator |

($/t processed) | $20.92 |

G&A |

($/t processed) | $10.55 |

Concentrate Trucking & Port Charges |

($/t wet concentrate) | $4.92 |

Concentrate Shipping |

($/t wet concentrate) | $15.00 |

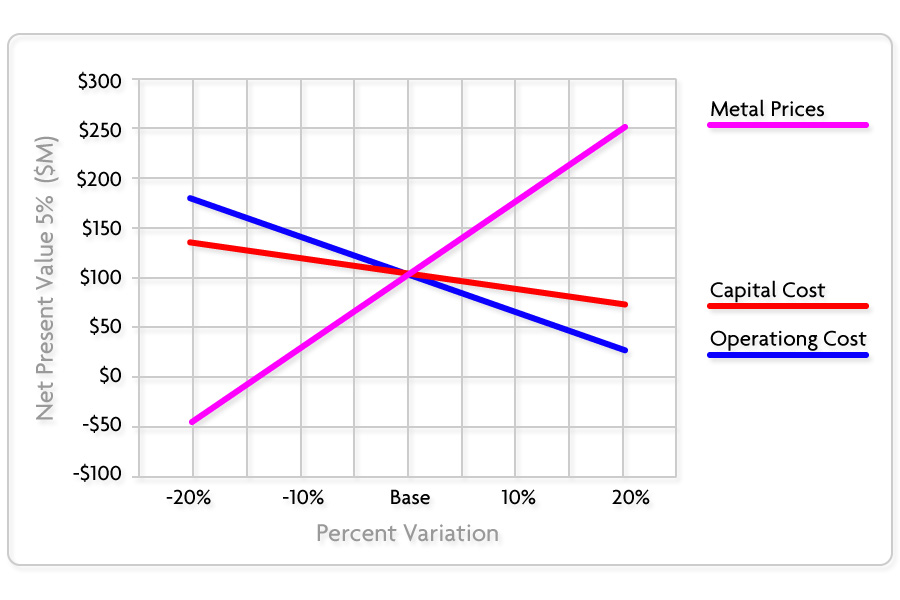

Economic Analysis

The results of the economic analysis represent forward-looking information. The results depend on inputs that are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those presented here. Factors that could cause such differences include, but are not limited to: changes in commodity prices, costs and supply of materials relevant to the mining industry, the actual extent of the mineral resources compared to those that were estimated, actual mining and metallurgical recoveries that may be achieved, technological change in the mining, processing and waste disposal, changes in government and changes in regulations affecting the ability to permit and operate a mining operation. Forward-looking information in this analysis includes statements regarding future mining and mineral processing plans, rates and amounts of metal production, royalty terms, smelting and refinery terms, the ability to finance the project, and metal price forecasts.

Key Assumptions Used in Economic Modeling

Zinc Price USD 0.85/lb

Copper Price USD 2.50/lb

Gold Price USD 900/oz

Silver USD 12.00/oz

TC Zinc USD 140.00

TC/RC Copper USD 35/04

Project Economic Summary

Total Undiscounted Cash Flow 222 million

IRR 13.2%

Product Marketing

The estimated commence of production is anticipated to be during the 3rd quarter of 2011 which should initiate shipment of concentrates during the 1st quarter of 2012.

The concentrates will be exported, in bulk, from the mine to the loading port of Gizan where they will be stockpiled and loaded on ocean-going vessels. The proximity of the loading port to various consumers in India, China, Japan, Korea and Europe will make the concentrates attractive to smelters in these regions.

Concentrate sales agreements will be structured as long term agreements with a minimum period of 5 years.

On average the process plant will annually produce 35,000 tonnes of copper concentrate containing precious metals and 45,000 tonnes of zinc concentrates. On an average 7,600 oz of gold and 193,000 oz of silver in dore will be produced annually.

The marketability of all products from the project is high as the products are clean by metallurgical standards; the logistics are excellent (close to smelters); the future demand for the products is excellent.

Exploration Potential

The exploration potential can be categorized in two areas:(i) the immediate mine area and

(ii) area within the Greater Al Masane concessions

The immediate mine area was explored by diamond drilling from underground. Potential for additional mineralization was recognized in the Al Houra zone, which continues below the 100 m level.

Within the exploration concession area, gossan showings anomalous values in lead and zinc were reported. These showings have not been investigated by diamond drilling. Ancient copper workings and gossans are known 5 km north of the Al Masane mine.

Outside the Al Masane mine area there is a large copper geochemical anomaly associated with gold bearing quartz veins near Jabal Guyan.

The most promising area known to date is at Talaa, 20km south of Al Masane, where 3 exploratory drill holes intercepted copper, zinc mineralization. The favorable horizon has been traced for at least 6 km by geochemical sampling.